free crypto tax calculator reddit 2020

Straightforward UI which you get your crypto taxes done in seconds at no cost. Get your 2020 taxes done.

Germany Crypto Tax Guide 2022 Koinly

Bank submits 1099 to IRS.

. As of December 31st 2020 cryptocurrencies are considered virtual currency and must be disclosed as part of a 1040 filing. Starting today cryptocurrency users with up to 25 transactions in a given tax year can use CoinTracker to calculate cryptocurrency taxes free of charge. You can see the Federal Income Tax rates for the 2021 and 2022 tax years below.

Janes estimated capital gains tax on her crypto asset sale is 1625. Youll only start to pay Income Tax when you hit 18200 in total income per year. Log in to your account.

Prepare federal and state income taxes online. TokenTax is one of the most extensive tax calculation and reporting software out there for any crypto trader. Jan 21 2020 2 MIN READ.

Supports DeFi NFTs and decentralized exchanges. But remember - youll only pay tax on half your capital gain. We are excited to announce new pricing that enables beginner cryptocurrency users to automatically calculate their taxes for free.

Ethereum Solana and more. Crypto taxpayers can use the Libra Tax calculator for free for up to 500 transactions while the paid subscription allows them to track 5000. - Opens the menu.

Were still picking up a lot of customers who were trading in 20172018. Differentiate your business with the gold standard in crypto tax compliance. The Crypto Tax Girl website also offers free tax tips while Lauras YouTube page has more crypto tax explanation videos.

A distributed worldwide decentralized digital money. Free 0 Youre welcome. You didnt declare it in your form.

Income 2021 Income 2022 15. Integrates major exchanges wallets and chains. 2021 tax preparation software.

File 2016 Tax Return. Those are just skimming the top for the noobs as they say. IRS is known to ask questions when people forgot their 10 interest on checking account.

Best Crypto tax reporting and calculation software. Crypto tax breaks. Laura has had over 200 clients come to her for cryptocurrency tax filings including individuals small business owners C-suite level business executives expats students high and low-income earners and others.

File 2019 Tax Return. Get Started For Free. Efile your tax return directly to the IRS.

File 2020 Tax Return. Heres an example of how to calculate the cost basis of your cryptocurrency. UK crypto investors can pay less tax on crypto by making the most of tax breaks.

Instead your crypto capital gains are taxed at the same rate as your Federal Income Tax rate and Provincial Income Tax rate. Bitcoin is the currency of the Internet. Free Hobbyist Premium Unlimited Transactions.

With our bitcoin tax reporting tool you can identify the cost basis of your crypto when purchased and. Full integration with popular exchanges and wallets in Canada with more jurisdictions to come. File 2015 Tax Return.

50 Capital Gains Tax discount. Calculate and report your crypto tax for free now. The 1 feature I care about in a crypto tax software is does it support an accounting method that saves me the most tax money by minimizing capital gains.

Unlike traditional currencies such as dollars bitcoins are issued and managed without any central authority whatsoever. Covers NFTs DeFi DEX trading. I wrote RP2 the privacy-focused free open-source US cryptocurrency tax calculator up to date for 2021.

There is no government company or bank in charge of Bitcoin. File 2018 Tax Return. The brothers founded the.

The resulting number is your cost basis 10000 1000 10. Use our Crypto Tax Calculator. Accurately calculate your cryptocurrency taxes for January 1 2020 to December 31 2020.

This is why cryptocurrency tax Shane explains is kind of a lagging market. This is why cryptocurrency tax Shane explains is kind of a lagging market. 12570 Personal Income Tax Allowance.

IRS knows about this 10 interest. Your first 12570 of income in the UK is tax free for the 20212022 tax year. The best way to choose them and save on your taxes is to use a free crypto tax calculator like ZenLedger.

The business plan comes at 99 per month and covers 10K taxations and 20 million in assets. Sort out your crypto tax nightmare. Blox supports the majority of the crypto coins and guides you through your taxation process.

Youve probably heard of LIFO vs. There are cloud-hosting tools specifically designed for crypto miners. 100 Free Tax Filing.

Log in with Google. IRS will highly likely go after a possible 3k profit that they have a documentation of. It handles multiple coinsexchanges and computes longshort-term capital gains cost bases inout lot relationships and account balancesIt supports FIFO and LIFO and it generates output in form 8949 format so that tax accountants can understand it even without being.

If not look elsewhere. As such it is more resistant to wild inflation and. CoinTracker is the most trusted Bitcoin Tax Software and Crypto Portfolio Manager.

If you hold your cryptocurrency for more than a year before selling or trading it you may be entitled to a 50 CGT discount. File 2017 Tax Return. File 2014 Tax Return.

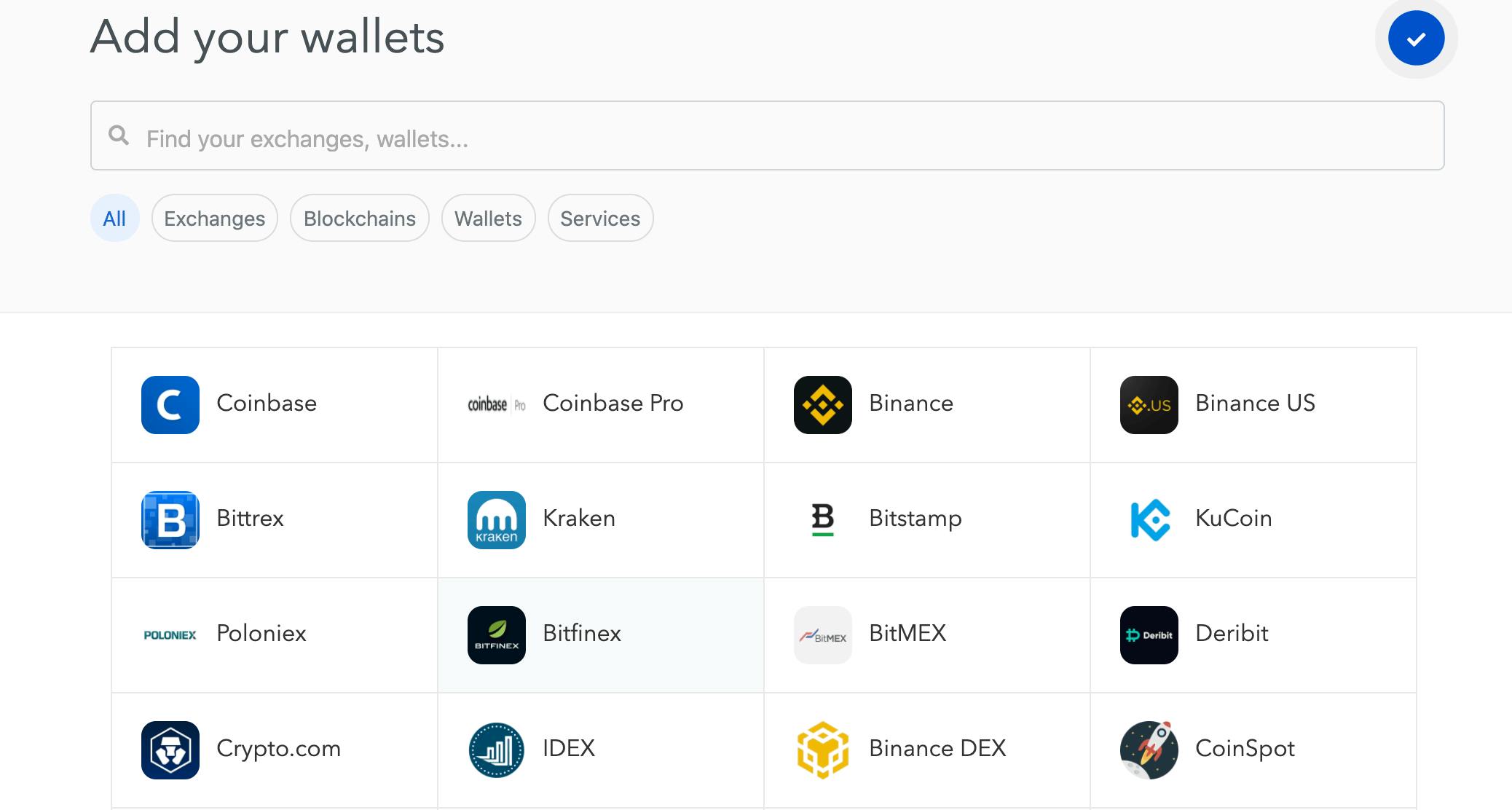

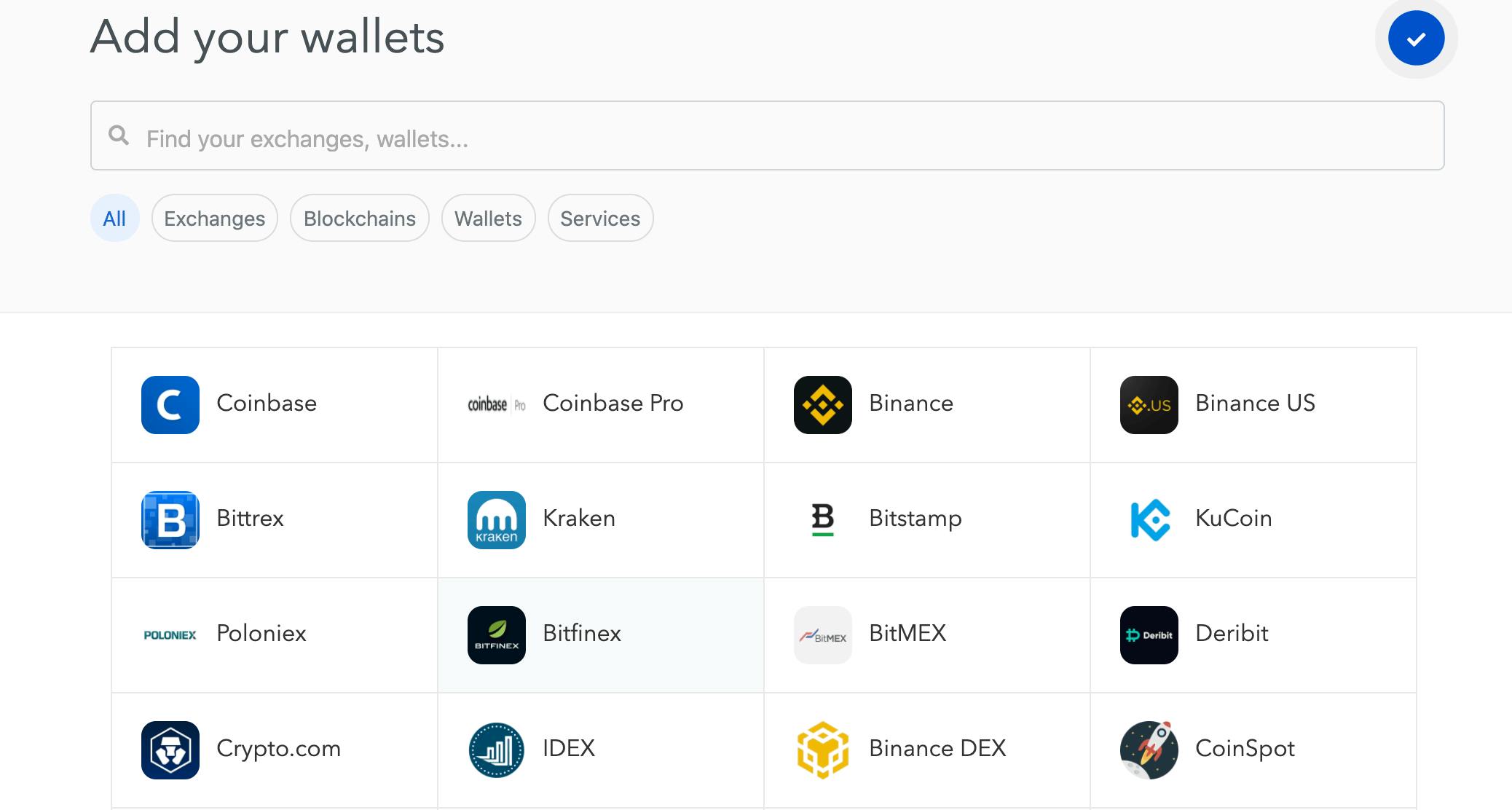

Automatically connect Coinbase Binance and all other exchanges wallets. Try out the mobile app. Divide the initial investment amount with the amount of crypto purchased lets assume 1000 coins.

You report these taxable events on your tax return using various. New but absolutely amazing is zenledgerio it enables investors and CPAs to import cryptocurrency transactions calculate gains and income and auto-fill tax forms. Using ZenLedger cryptocurrency investors can manage their portfolio generate profit loss statements file their taxes and avoid IRS audits.

Blox free Pro plan costs 50K AUM and covers 100 transactions. The platform has made the entire process hassle-free by integrating with almost every crypto exchange out there. Take the initial investment amount lets assume it is 1000.

How To Calculate Crypto Taxes Koinly

Taxes On Cryptocurrency In Spain How Much When How To Pay

Australian Crypto Tax Guide R Bitcoinaus

How Is Cryptocurrency Taxed Forbes Advisor

Quarterly Taxes On Crypto Koinly

Crypto And U S Income Taxes When And How Is Crypto Taxed As Income Coinbase

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

Defi Cryptotax Guide Swaps Liquidity Pools And Yield Farming Blockpit Cryptotax

Crypto Taxes Are A Shit Show R Cryptocurrency

Digital Decentralization Is Just The Beginning The Real World Will Follow Bitcoin Mining Pool Historical Data Mining Pool

Learn How To Do Your 2021 Cryptocurrency Tax With Koinly Watch

Cost Basis What Is It And How It Can Help You Calculate Your Crypto Taxes Coinbase

Australia Crypto Tax Guide 2022 Koinly

Serious How Are You Dealing With Crypto Tax In 2020 2021 R Cryptocurrency

How To Calculate Crypto Taxes Koinly

Do You Pay Tax On Lost Stolen Or Hacked Crypto Koinly

Us Crypto Tax Software Options Your Preference Experience R Cryptocurrency